Fintech.

Building a centralized platform for impact investing intelligence

Case Study

At a glance

We worked with Tameo, a Geneva-based fintech startup, utilizing a UX + Agile methodology to develop Tameo Analytics. This market intelligence platform offers detailed insights and tools for impact investors, significantly enhancing user engagement and strategic decision-making.

Client

Sector

Financial Services

Project

Market intelligence platform

Activities

Functional workshops

Design thinking workshop

Benchmark

Personas

User flows

Mood boards

UI design

Wireframes

Prototyping

Design System

Development in Agile sprints

Quality testing and UX QA

Technologies

UXPin

Vue.js

Tailwind CSS

Highcharts

GraphQL

HeadlessUI

.Net

As agile as it gets

Whitespace used a UX + Agile development methodology to deliver the first release of the solution within 8 months. The team at Whitespace conducted several functional and design workshops, designed hand-in-hand a clickable prototype in UXPin, and implemented the solution in Vue.js and .Net.

The collaboration between Tameo and Whitespace has been extremely smooth, efficient, and enjoyable. The platform was released on time and received very positive feedback from stakeholders, and the collaboration between Tameo and Whitespace will continue expanding with future projects already in the pipeline.

The Whitespace team was able to adapt perfectly to the specificities of our organization. We appreciated their professionalism and availability. The collective intelligence approach during the workshops allowed us to reach a consensus and helped us formalize our needs and the design of our new application.

We enjoyed their support for our project. An excellent collaboration that is just beginning.

Gilles Bayon, Chief Technology Officer

Tools and intelligence for sustainable investing

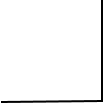

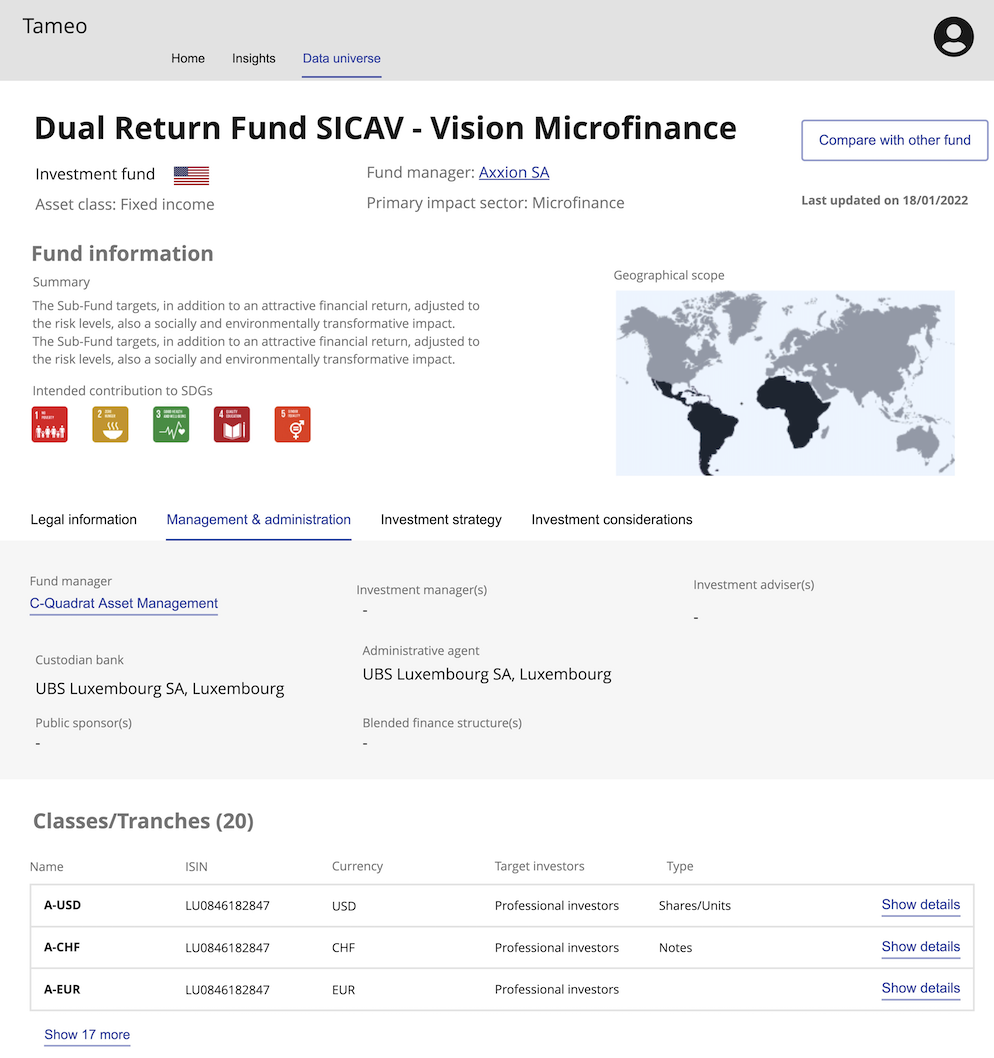

The Tameo Analytics platform provides free and subscription-based access to:

- 321 impact fund managers geographically located in 36 countries across the globe and spanning over 10 impact sectors such as Micro-finance, Climate & Energy, Food & Agriculture, Healthcare, and Housing;

- 529 funds with a cumulative market size of US $77 billion.

It features an impact investing news and publications aggregator, a powerful search engine, and a fund comparison tool, empowering Investors and Fund Managers to review and select impact funds per their intended contributions to the sustainable development goals set by the United Nations, impact sectors, and geographical scope.

The user interface design has been developed in a dark mode to help reduce eye fatigue and glare, as well as reduce carbon footprint. It is optimized for use on mobile and desktop and is compatible with strict accessibility standards.

Key stats

500+

Impact investment funds

8

Months to MVP release

300+

Impact investment fund managers

10+

Impact sectors covered

Nathalie Raux-Copin

UX Director

Tameo Analytics has been one of the most fluid projects I've worked on, thanks to an excellent Agile approach and team spirit. This start-up will go a long way in pioneering and growing impact funds, and I’m proud to have been involved in making the product user-centric and stylish.

More from our portfolio

Your work here?